how to decide on term life insurance

Your actual premium will be determined by underwriting review. Quotes reflected are an example from Policy Genius.

Converting Term Life Insurance Money

The premium of the policy.

. This disparity is because with term life insurance the. Identify your needs and the term insurance coverage you seek. Claim Settlement ratio of a company informs you about the number of policies that are.

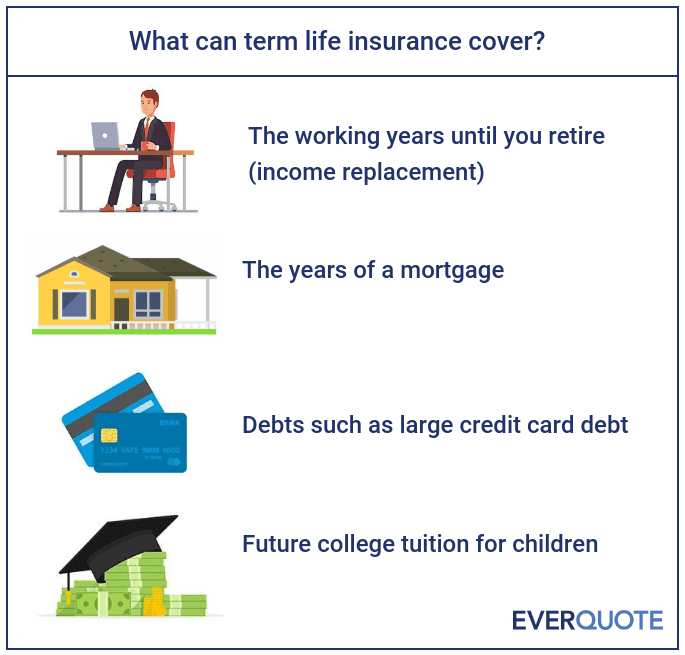

Payout If your premium payments are current your beneficiary is. Your premium price for a term life insurance is going to be cheaper than it is for a whole life policy. Term insurance meanwhile only covers a certain period such as a 10-.

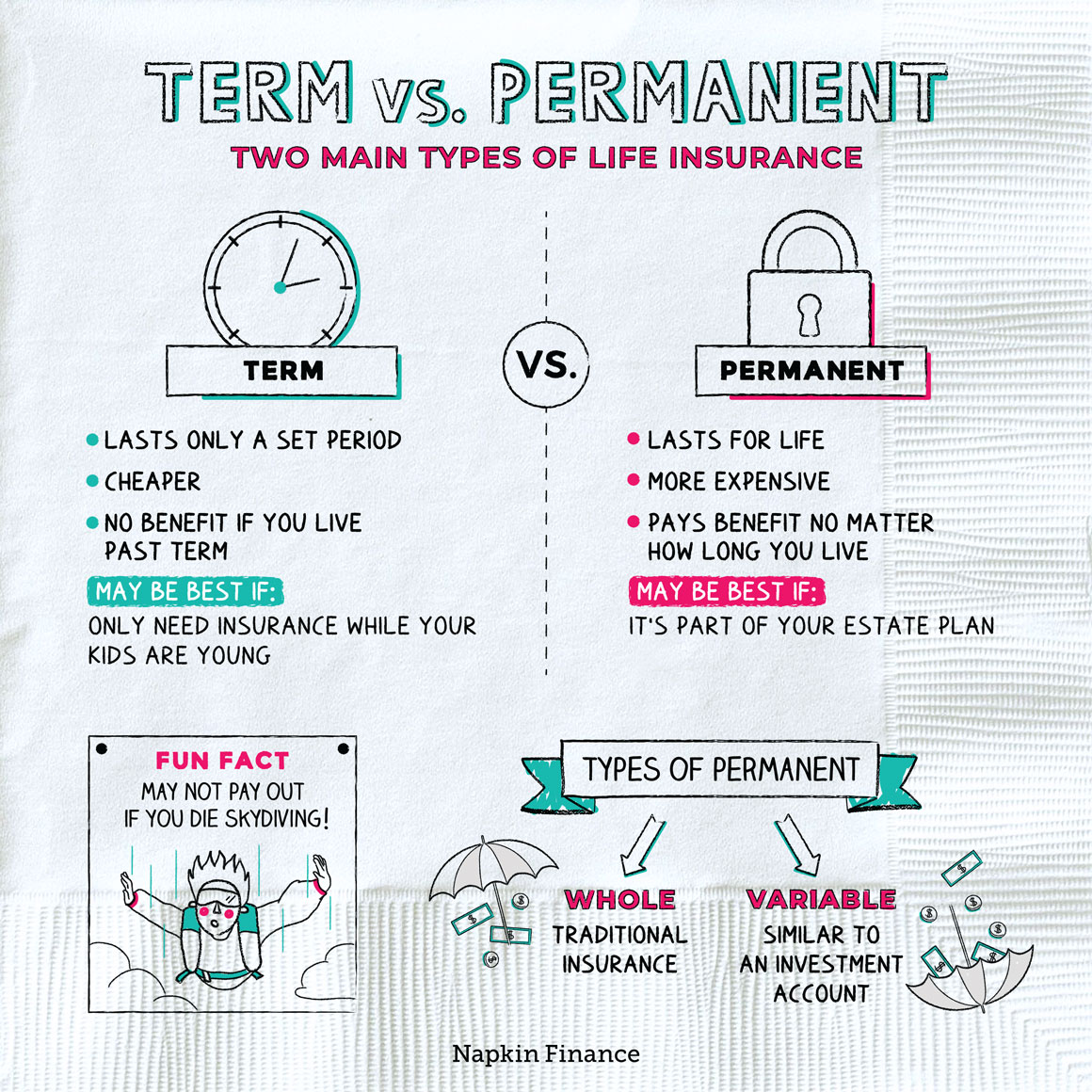

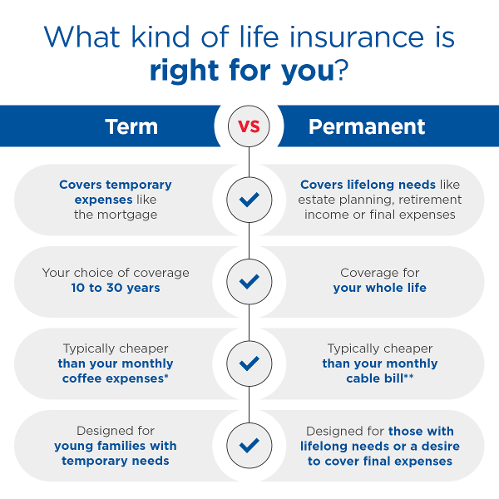

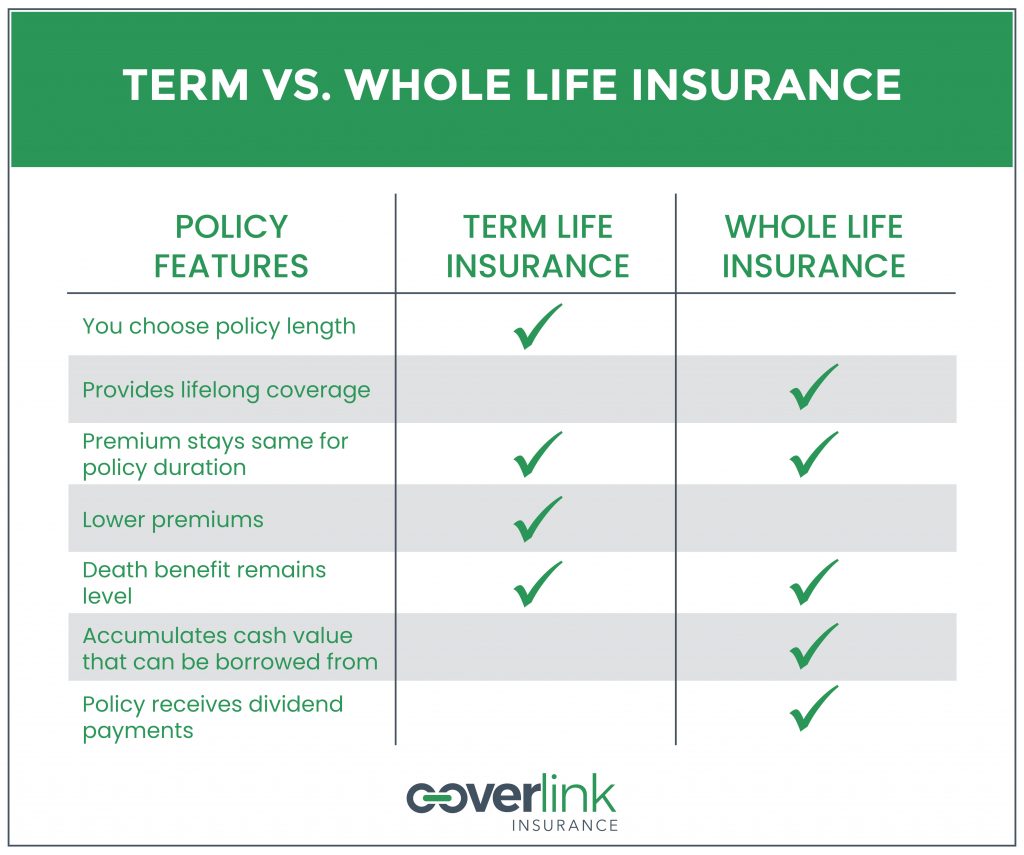

Also known as pure life insurance term life insurance is a type of policy that guarantees payment of a death benefit during a set term. Both whole and term life pay a death benefit to those left behind but there are differences in the cost and how long youre covered. Whole policies can provide more stability while term policies can help reduce risks within particular life stages.

Compare and Buy Life Insurance Term. For many a 20-year term is a popular option because of its hybrid of length and affordability. Two main types to consider include whole life insurance which covers you for however long you live.

Liberty mutual insurance company is an insurance company which offers coverage for individuals families and businesses. If the term life insurance policy. Life insurance can be a good.

Benefits of Term Life Insurance. The longer the term obviously the higher. Whole life insurance monthly premiums are higher than term life premiumsfive to fifteen times higher.

Life insurance has many variations such as term insurance ULIP endowment scheme and so on. Take for instance the premium rates of iProtect Smart term cover from. Ladder offers a unique form of on-demand term life insurance you can adjust as you go.

While choosing a term insurance plan one of the major points to consider is Claim settlement ratio. However the word that requires to be determined may be a complicated. Your overall life insurance cost will depend on health gender age and lifestyle choices.

Alternatively check out our Ladder life insurance review. Term life insurance is usually more economical than whole life insurance. It could be the right call if.

The average cost of a 20-year term life insurance policy is 252 a year for 500000 in coverage for a 30-year-old female based on Forbes Advisors analysis of life. Based on the tenure the insurance company keeps on increasing your term insurance premium. Your term insurance coverage should broadly assess how much financial resources your.

On average here is what you can expect to pay per month. Premiums drop several dollars a month compared to 30-year policies but you.

Term Vs Permanent Life Insurance Napkin Finance

Term Life Vs Whole Life Insurance Moneyunder30

A Financial Planner Explains How To Choose A Life Insurance Policy

Life Insurance Coverage For You And Your Family Everquote

Term Vs Permanent Life Insurance Aaa Life Insurance Company

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

Best Term Life Insurance Companies Of 2022 U S News

Term Whole Life Or Return Of Premium Life Insurance How To Choose Coverlink Insurance Ohio Insurance Agency

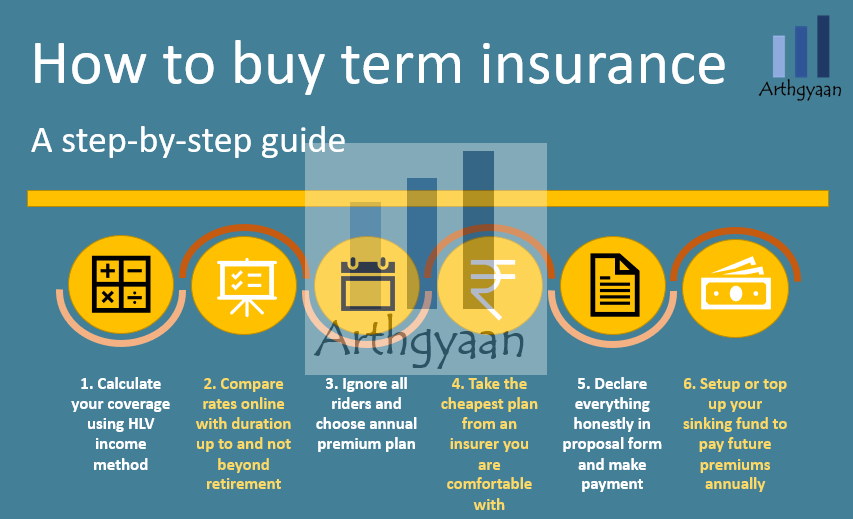

Term Life Insurance What Why How Much To Get And From Where Arthgyaan

Term Life Insurance Vs Permanent Life Insurance Cb Acker Associates

Can You Sell Your Term Life Insurance Policy For Cash

What Is A 10 Year Term Life Insurance Policy

What Is Term Life Insurance Experian

Whole Vs Term Life Insurance Let S Do The Math Smart Money Mamas

Term Life Insurance Vs Whole Life Insurance Which Should You Get Planner Bee

What Is Term Life Insurance And How Does It Work Thrivent

Understanding Life How Can I Choose The Best Term Life Insurance Policy

When Whole Life Insurance Is Better Than Term Life Insurance With 10 Real World Examples